The Main Principles Of Largest Retirement Community In Florida

The Attained Age Vs Issue Age Statements

Table of Contents9 Simple Techniques For Hearing Insurance For SeniorsThe smart Trick of Boomerbenefits Com Reviews That Nobody is DiscussingAll about Largest Retirement Community In FloridaGet This Report about Boomerbenefits Com ReviewsGetting The Boomerbenefits Com Reviews To WorkThe Best Strategy To Use For Boomerbenefits.com Reviews

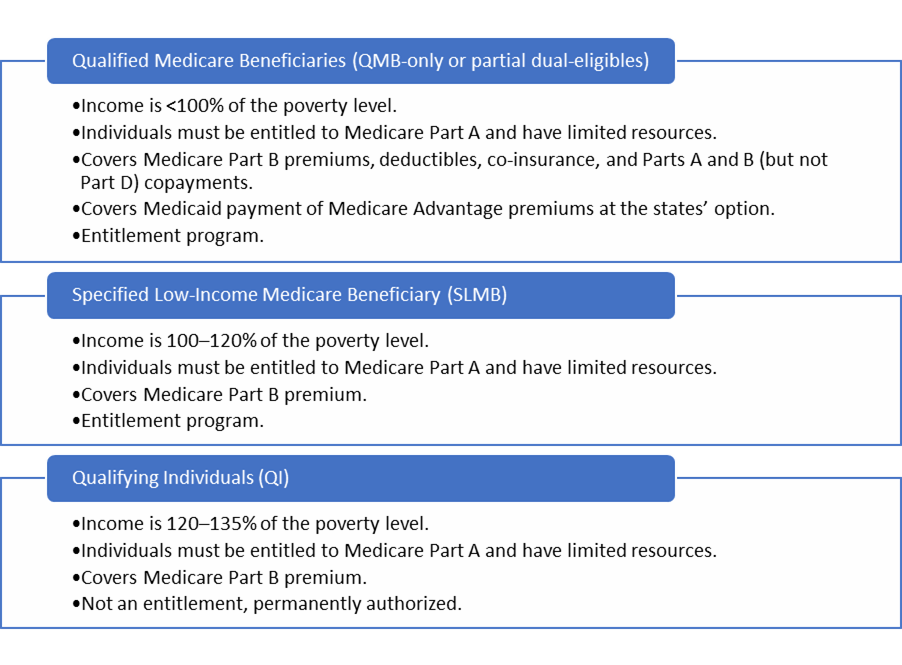

Nelson does not need to file an application for Premium-Part A because he stays in a Component A Buy-in State. (Note: If Maryland approves Mr. Nelson's application for the QMB Program, the State will certainly enlist him in State Buy-in due to the fact that he already has Component B.Check out below to locate out-- If he has Medicaid or QMB, just how much will Medicaid pay?!? SHORT RESPONSE: QMB or Medicaid will certainly pay the Medicare coinsurance only in minimal situations.

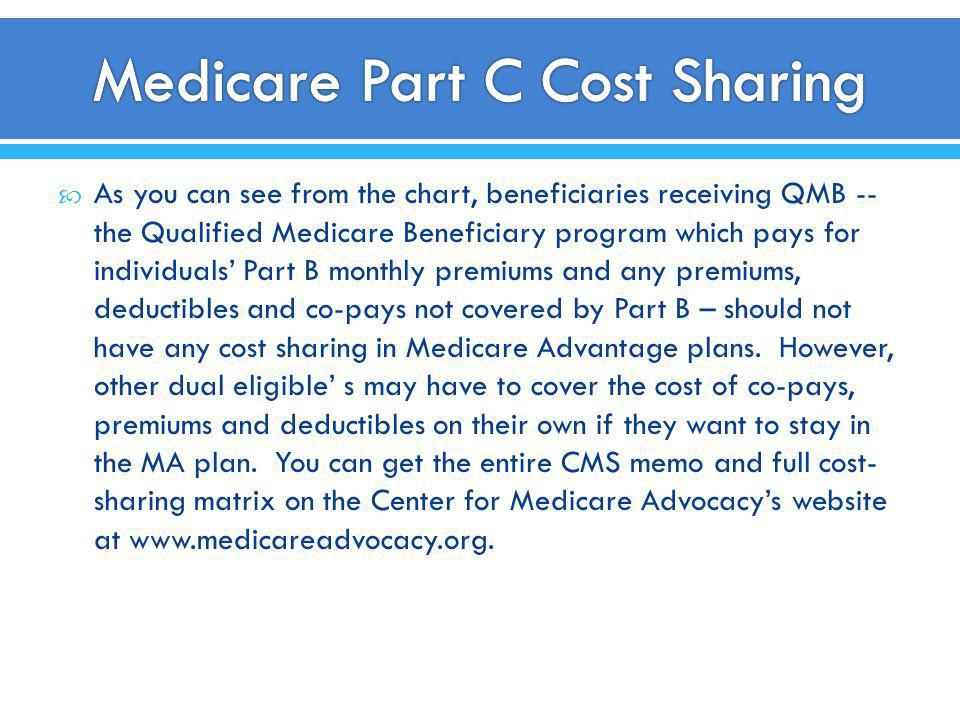

Second, also if the carrier approves Medicaid, under current regulation in New York passed in 2015 and also 2016, QMB or Medicaid may pay just component of the coinsurance, or none at all. This depends partly on whether the beneficiary has Initial Medicare or is in a Medicare Advantage strategy, as well as partially on the kind of solution.

The smart Trick of Boomerbenefits Com Reviews That Nobody is Talking About

This creates stress between a specific and also her medical professionals, drug stores giving Component B medications, and other carriers. Service providers may not know they are not allowed to bill a QMB recipient for Medicare coinsurance, since they bill various other Medicare recipients. Even those that recognize may pressure their patients to pay, or just decline to offer them.

The provider expenses Medicaid - even if the QMB Beneficiary does not likewise have Medicaid. Medicaid is required to pay the service provider for all Medicare Component An and B cost-sharing costs for a QMB beneficiary, also if the solution is typically not covered by Medicaid (ie, chiropractic care, podiatry and professional social job care).

Cuomo has actually recommended to lower how much Medicaid pays for the Medicare costs also additionally. The amount Medicaid pays is various depending upon whether the individual has Initial Medicare or is a Medicare Benefit strategy, with far better repayment for those in Medicare Benefit plans. The response also differs based on the sort of solution.

The Plan G Medicare Statements

If the Medicaid price for the same service is just $80 or much less, Medicaid would pay nothing, as it would certainly think about the doctor totally paid = the carrier has actually gotten the complete Medicaid price, which is lower than the Medicare price. s - Medicaid/QMB wil pay the full coinsurance for the following services, despite the Medicaid price: rescue as well as psychologists - The Gov's 2019 proposal to remove these exceptions was denied.

Manhattan Life Assurance Things To Know Before You Buy

50 of the $185 authorized rate, service provider will hopefully not be deterred from serving Mary or other QMBs/Medicaid recipients. - The 20% coinsurance is $37. Medicaid pays none of the coinsurance because the Medicaid rate ($120) is less than the quantity the supplier already received from Medicare ($148). For both Medicare Benefit and also Original Medicare, if the expense was for a, Medicaid would certainly pay the complete 20% coinsurance no matter of the Medicaid rate.

If the service provider desires Medicaid to pay the coinsurance, then the supplier needs to register as a Medicaid provider under the state guidelines. This is a modification in plan in executing Area 1902(n)( 3 )(B) of the Social Safety And Security Act (the Act), as customized by section 4714 of the Balanced Budget Act of 1997, which forbids Medicare providers from balance-billing QMBs for Medicare cost-sharing.

This area of the Act is offered at: CMCS Informational Publication . QMBs have no legal responsibility to make further repayment to a carrier or Medicare took care of care prepare for Component A or Part B expense sharing. Suppliers that wrongly expense QMBs for Medicare cost-sharing are subject to permissions. Please note that the law referenced above supersedes CMS State Medicaid Guidebook, Chapter 3, Eligibility, 3490.

9 Simple Techniques For Medigap Plan G

CMS reminded Medicare Advantage plans of the guideline versus Equilibrium Billing in the 2017 Call Letter for strategy renewals. See this excerpt of the 2017 phone call letter by Justice in Aging - It can be hard to reveal a carrier that a person is a QMB. It is especially tough for companies who are not Medicaid suppliers to recognize QMB's, because they do not have accessibility to on-line Medicaid eligibility systems If a customer reports an equilibrium billng trouble to this number, the Customer Solution Associate can intensify the issue to the Medicare Administrative Contractor (MAC), which will send a conformity letter to the provider with a copy to the customer.

Medicaid pays none of the coinsurance since the Medicaid price ($120) is reduced than the quantity the company currently obtained from Medicare ($148). For both Medicare Benefit and also Original Medicare, if the expense was for a, Medicaid would pay the full 20% coinsurance no matter of the Medicaid price.

If the provider desires Medicaid to pay the coinsurance, after that the provider must register as a Medicaid company under the state policies. This is a change in policy in implementing Section 1902(n)( 3 )(B) of the Social Safety Act (the Act), as changed by area 4714 of the Balanced Budget Plan Act of 1997, which restricts Medicare carriers from balance-billing QMBs for Medicare cost-sharing.

3 Simple Techniques For Aarp Medicare Supplement Plan F

QMBs have no lawful obligation to make more payment visit to a supplier or Medicare handled care strategy for Component A or Part B price sharing. Companies who wrongly expense QMBs for Medicare cost-sharing are subject to permissions.

CMS reminded Medicare Advantage plans of the guideline against Equilibrium Billing in the 2017 Call Letter for plan renewals. See this excerpt of the 2017 call letter by Justice in Aging - It can be difficult to show a provider that one is a QMB. It is particularly difficult for carriers that are not Medicaid suppliers to determine QMB's, given that they do not have access to on-line Medicaid eligibility systems If a consumer reports an equilibrium billng trouble to this number, the Customer care Representative can rise the problem to the Medicare Administrative Service Provider (MAC), which will send a conformity letter to the provider with a copy to the customer.